posteriori

What's The Deal?

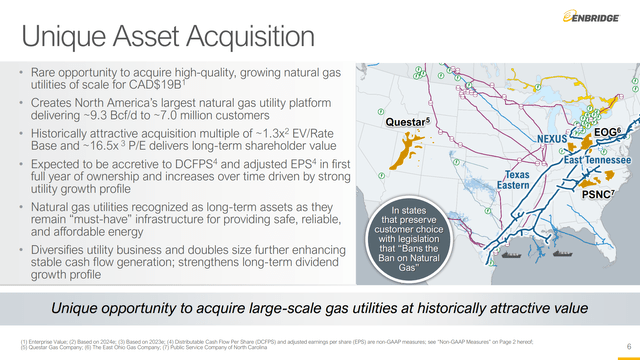

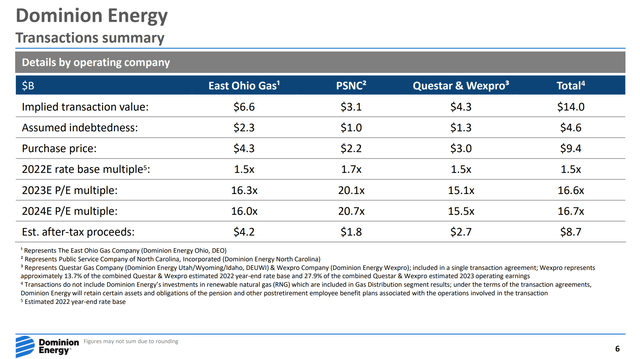

Enbridge (NYSE:ENB) (TSX:ENB:CA) announced that it is buying the gas distribution utilities of Dominion Energy (NYSE:D) in a deal that values the businesses at $14 billion USD enterprise value. This includes $9.4 billion in cash and $4.6 billion assumed debt of the subsidiaries. The businesses are three US-based natural gas utilities: East Ohio Gas, Public Service Company of North Carolina, and Questar. The latter is predominantly Utah-based and also includes Wexpro, an upstream producer of natural gas.

Enbridge

The attractive points of the deal according to Enbridge is that it doubles the size of the company's existing gas distribution utility business which is presently based only in Canada. It also diversifies Enbridge's business mix, taking the liquids pipeline business, often beleaguered by regulators and ESG proponents, down to 50% of the company. Enbridge notes that the utilities are located in states that are friendly to natural gas usage, although North Carolina passed legislation in 2021 requiring a 70% reduction in carbon emission by 2030.

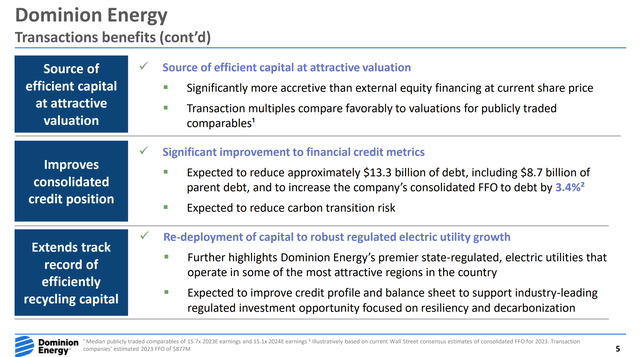

From Dominion's point of view, the deal reduces total debt by about 1/3. It also "is expected to reduce carbon transition risk", setting up the company to focus on regulated electric utilities.

Dominion

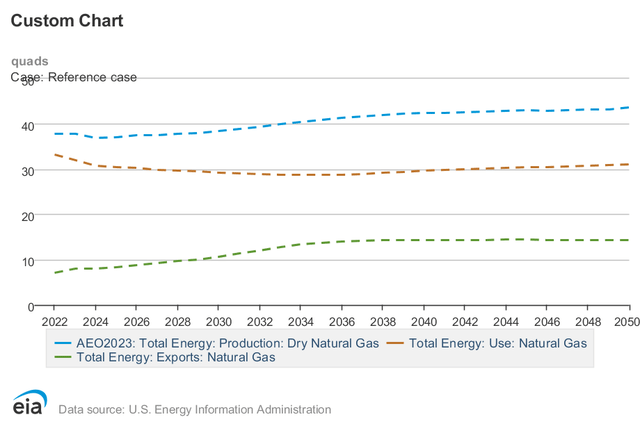

The three utilities are high quality assets, with return on equity averaging 10%. Two of the three are in areas with strong population growth, allowing the combined rate base to grow at 8% per year. Natural gas will be a necessary part of the energy balance in the US for decades to come. The EIA projects US consumption to stabilize from 2030-2050 after a slight decline as production and exports continue to grow.

EIA

How can such a great asset be a bad deal for both sides? For Dominion, they are abandoning a profitable business in pursuit of their own ESG goals without any net benefit to society as a whole. In the case of Enbridge, nearly all the economic benefits of the deal are lost to interest expense from added debt and EPS dilution from share issuance. Let's look at the math of the deal to see what I mean.

Dominion - ESG At A Cost

Dominion appears bound and determined to improve their ESG ratings by becoming an electric-only utility. Of course, selling off the gas-related businesses does nothing for the planet if other companies continue to operate them. The company already sold its interest in the Cove Point LNG facility to Berkshire Hathaway (BRK.A) (BRK.B) and now plans to exit gas distribution as well. The company plans to pay off debt but will eventually have to spend massive amounts on renewable energy generation projects such as offshore wind on the US east coast. Overall, Dominion plans to spend $72 billion on decarbonization by 2035, including $32 billion by 2025. Similar projects are proving more costly than originally anticipated. Even highly green European energy companies like BP (BP) and Equinor (EQNR) are demanding higher returns for their offshore wind projects before moving forward.

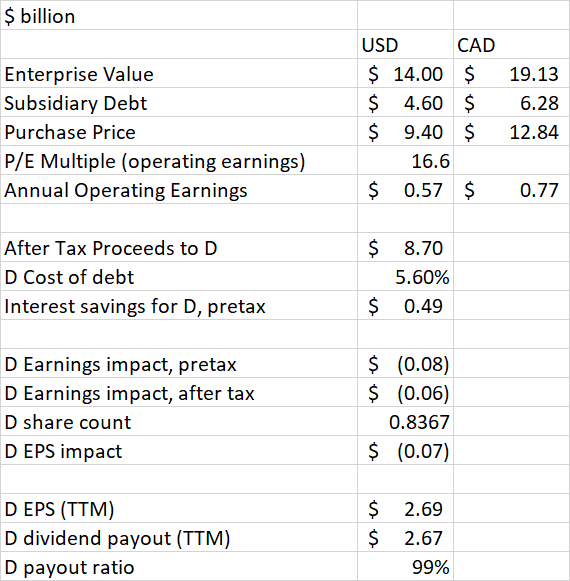

Narrowing our scope back down to just the gas utility sale, the transaction looks like it will have a negative impact on Dominion's earnings. This is based off the following information from Dominion's slide presentation on the deal.

Dominion Energy

The three utilities together have estimated pretax operating earnings of about $570 million this year. The company will net $8.7 billion of cash from the deal after taxes. Using a cost of debt of 5.6%, the company can save about $490 million in interest costs assuming all the cash is put toward debt reduction. As you can see, that leaves Dominion $80 million worse off. Maybe that's a small price to pay for improving one's ESG score, even if Earth is no better off. After all it's just $0.07 per share of earnings. The problem is Dominion already cut its dividend once in 2020 by 33% and has only done one 6% increase since then, at the start of 2022. The company had a payout ratio of 99% over the last four quarters, so even a small loss of earnings power leaves Dominion at risk of another dividend cut or at best a long period without a significant increase.

Author Spreadsheet

Enbridge - Too Much Debt

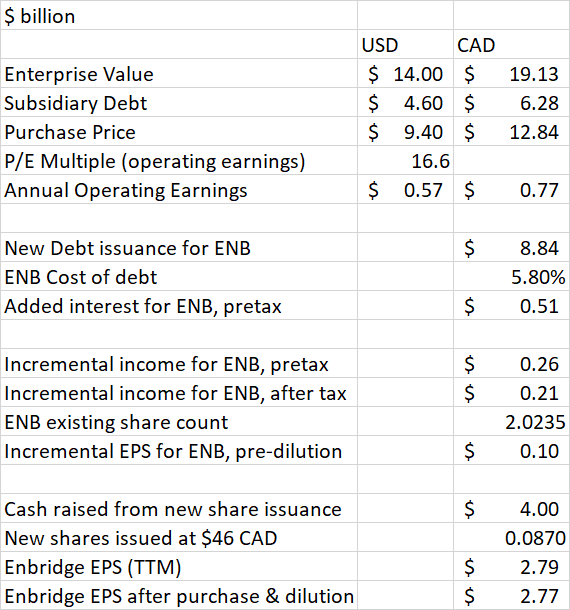

Enbridge will pay $13 billion Canadian for the utilities, not including the $6 billion Canadian of the subsidiaries' debt. Enbridge will need to issue almost $9 billion Canadian of parent company debt as well as $4 billion in stock to fund this deal. The $570 million US of pretax operating income mentioned above translates to $770 million Canadian. Assuming a cost of debt of 5.8%, Enbridge will incur about $510 million Canadian of additional interest expense. That $260 million of net pretax benefit is about $0.10 per share of incremental EPS. Unfortunately, that's before dilution from the $4 billion worth of new shares issued. Taking that into effect, I estimate a $0.02 per share dilutive impact from the acquisition.

Author Spreadsheet

Going back to Enbridge's deal presentation, they claim the deal is accretive to DCF and earnings per share in the first full year of ownership. However, they don't say by how much. It's possible that with just a slightly lower cost of debt or as little as $50 million of cost cuts, my math could also show an accretive deal. It's clearly not a slam dunk positive, however.

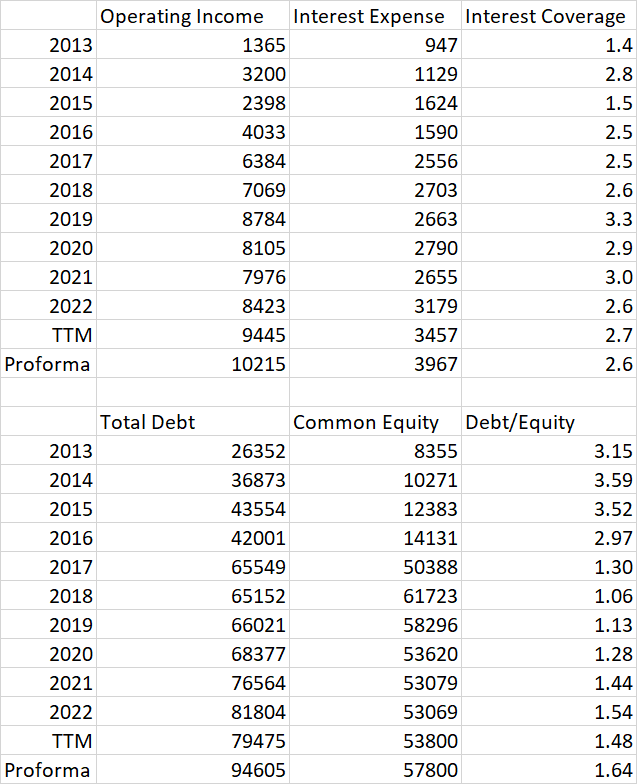

Enbridge has improved its balance sheet compared to 10 years ago with both interest coverage and debt/equity ratio having improved and stabilized. However, interest rates were falling for most of this period. The new deal does nothing to help the debt picture and could add to problems as Enbridge eventually needs to roll over debt at higher rates.

Author Spreadsheet (Data source: ENB:CA Seeking Alpha Financials page -Million Canadian dollars)

With higher interest rates and marginal acquisition economics, Enbridge needs to be careful not to fall into the trap that other pipeline companies and partnerships have fallen into before. These entities paid out dividends based on distributable cash flow rather than in free cash flow. This model works as long as profitable growth projects are available and the debt or equity markets are willing to fund them. If that stops, a dividend cut is inevitable, and the company must live within its means by funding growth and dividends from free cash flow. Kinder Morgan (KMI) found this out in 2015 and Western Midstream Partners (WES) learned this in 2020 as I warned in advance.

Conclusion

The three US gas utilities that Dominion is selling to Enbridge are good businesses with decent returns on equity. However, neither company involved in the transaction appears to be getting much benefit. Dominion looks like the worst of the two with a clear negative EPS impact at the same time the dividend is barely covered. The pursuit of a more ESG-friendly business mix comes with a financial hit and does nothing for the planet as long as other companies continue operating the assets. This does not look like wise decision making from management, and I do not want to be invested in such a company when there are many others that can improve shareholder returns while actually benefiting society. That makes Dominion a Strong Sell.

Enbridge is picking up some good businesses but the cost of debt and share dilution essentially offset any financial benefit. While the company had a history of good dividend growth, it has slowed in recent years. If this deal is indicative of what is available to the company in the future, Enbridge could eventually be limited to funding growth projects out of free cash flow. This could spell an end to dividend growth or even a dividend cut. I would rather own a business like WES that can grow and pay dividends without new financing. That makes Enbridge a Sell for me, but I am OK owning the preferreds as they are a small part of the capital structure and will remain well-covered.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

"lose" - Google News

September 07, 2023 at 09:33AM

https://ift.tt/c9f7CP1

Enbridge And Dominion Gas Utilities: Turning Great Assets Into A Lose-Lose Deal (NYSE:D) - Seeking Alpha

"lose" - Google News

https://ift.tt/w4joyTY https://ift.tt/iLBVk58

Bagikan Berita Ini

0 Response to "Enbridge And Dominion Gas Utilities: Turning Great Assets Into A Lose-Lose Deal (NYSE:D) - Seeking Alpha"

Post a Comment