Daniel Megias

It is widely considered that Warren Buffett has said:

Rule No. 1: Never Lose Money. Rule No. 2: Never Forget Rule No. 1.

Taken literally, this advice is near impossible to follow for investors. The simple fact is that stock prices are volatile and no one has the ability to time exact tops or bottoms.

But that's not what Buffett means. In fact, he acknowledges that prudent investors will often have to suffer through significant share price volatility. His advice:

You've got to be prepared when you buy a stock having them down 50 percent or more and be comfortable with it - as long as you're comfortable with the holding.

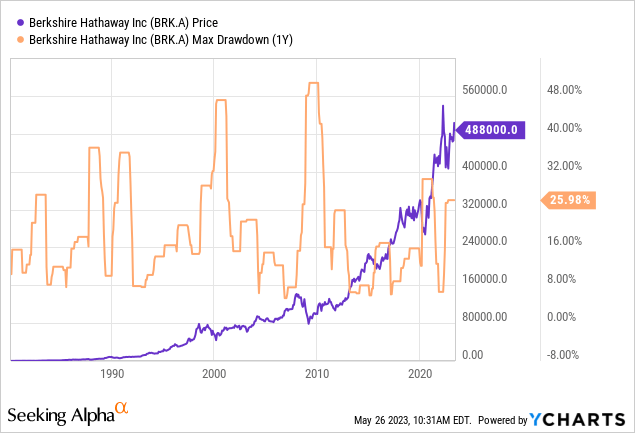

Mr. Buffett has pointed out before that even Berkshire Hathaway (BRK.A) (BRK.B) stock has declined by up to 50% several times in the past but that wasn't reason to sell. In fact, they did the opposite and added to their exposure. This has not prevented the shares from gaining 168,000% over the past 4 decades.

So what does this mean, exactly?

Mr. Buffett is referring to the value of the underlying business. Price is a fickle thing, value is not. Price can be discovered in an instant simply by searching for a ticker on Seeking Alpha or any other financial market site. Value requires much more effort and work to determine. In fact, it is difficult for any particular person to know everything there is to know about a company. Nonetheless, it is possible to know enough to be successful, and Mr. Buffett is living proof of this. Mr. Buffett is telling us not to make poor decisions that lead to losing money.

Don't Be Stupid

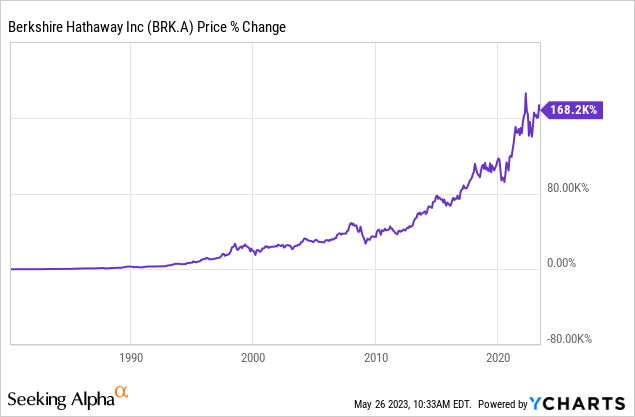

The way we view Buffett's advice can be said another way: don't be stupid. We believe that one of the best ways to manage our portfolio is by simply avoiding the poor investments. The GraniteShares XOUT U.S. Large Cap ETF (XOUT) is a fund based on this approach with the strategy of investing in large cap stocks excluding those that are expected to underperform. Up until the equity peak in 2021, the strategy was working. Today, it's mostly even with the S&P 500. The fund carries a hefty expense ratio of 0.6% which contributes to this outcome.

The advice "do not lose money" means to invest prudently. This requires due diligence, self discipline, and knowledge of business. This is a list of common investing habits that are not prudent (i.e. stupid):

- Investing in businesses that one does not understand

- Investing in businesses that were simply recommended by others

- Investing in good businesses at the wrong price

- Using too much leverage (including options)

- Investing for the wrong time-frame

There is a fine line between investing and speculating in equity markets. Speculation is merely a sophisticated term for gambling. Mr. Buffett is saying, don't gamble if you don't want to lose money.

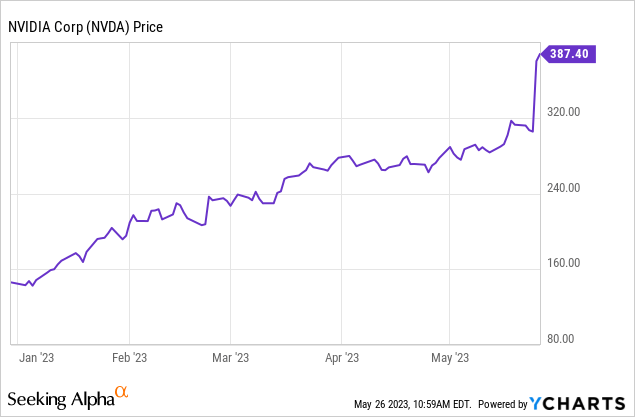

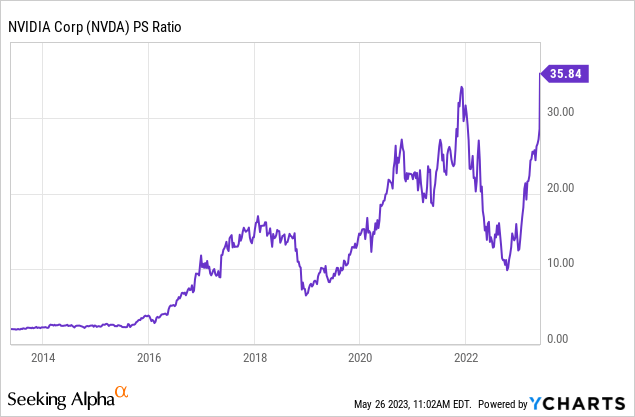

There has been much speculation over the past few years and speculation continues today. In recent headlines, NVDA shares have soared on strong guidance. Unfortunately, we have seen reports of life-altering losses on the short side of NVDA. Many of these trades involve leverage including options. Hindsight is 20/20 and there was no knowing where the share price would go. But let's call a spade a spade; this was gambling and it's not likely something that Warren Buffett would put his money in.

On the flip side, is it prudent to buy NVDA at today's prices? Without examining the company in detail (and it is a good company) the price to sales ratio above 35x alone is cause for alarm. Such a hefty price does not provide investors with much margin of safety. This is because out of the range of possible outcomes from very bullish to very bearish, only the most bullish of outcomes can support positive returns on this investment. Our expectation is that in the years to come this will be identified as clearly a case of overvaluation and not a prudent time to buy.

The Worst Offenders

During the middle of the bull market rally in 2021, the number of social media influencers giving financial advice ballooned. It coincided with the rise in popularity of Meme stock trading and the WallStreetBets Reddit forum. Come on people, it has "bets" in the name. Many thousands of investors made "investing" decisions based on the information from these sources, many of which were clearly inaccurate in describing businesses and how money works.

At one point, a famous social media influencer was buying stocks based on pulling scrabble letters out of a bag to put together a ticker symbol. At the time, we identified the behavior for what it was: speculation.

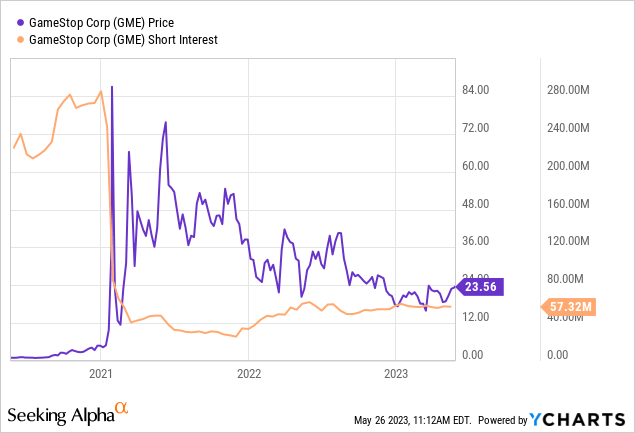

GameStop (GME) was the most famous of examples during this period. The giant short position and nostalgic value of the business overlooked its financials. Investors piling into the shares caused a short squeeze that morphed into a gamma squeeze. Shares rose by a staggering 12,400% from mid-2020 to its peak in 2021.

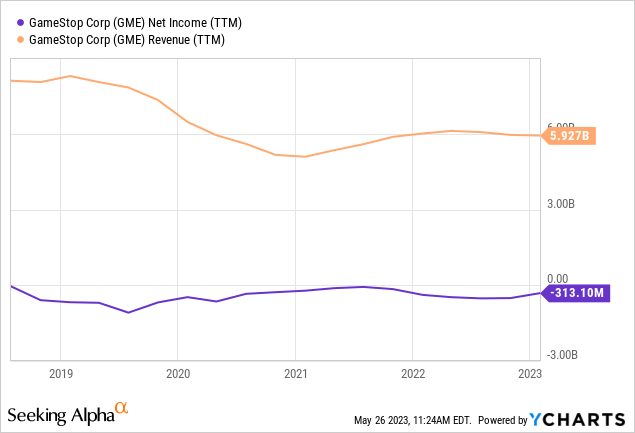

While the share price was volatile, financial performance was constant. GME continues to lose money due to negative net income over the past 4 years while revenues steadily decline. Without a major facelift, the business model is due for extinction in the same way that video rental stores were. The company is cash flow negative, EBITDA negative, and estimates don't expect that to change in the near term.

Seeking Alpha analysts have been very bearish on the stock and yet it continues to trade at 5.3x book value. Don't lose money.

Seeking Alpha

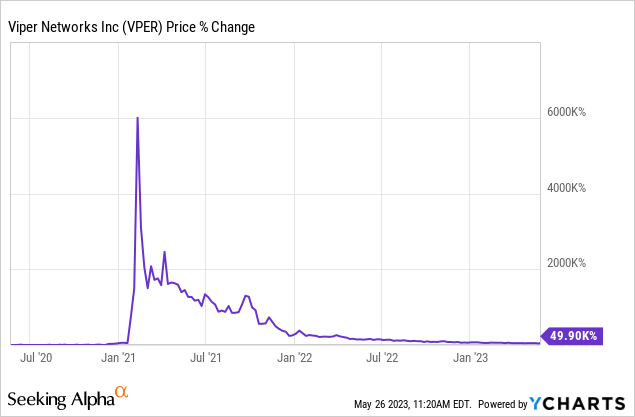

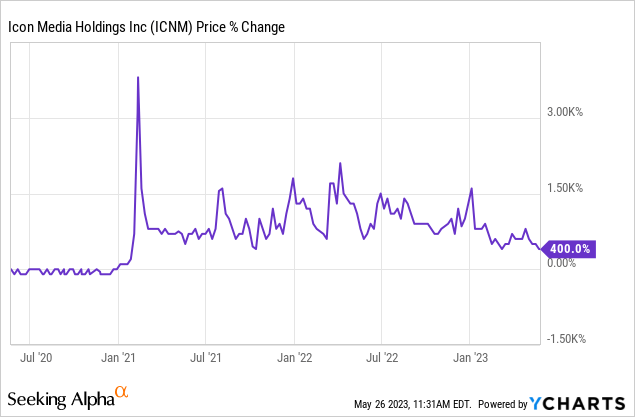

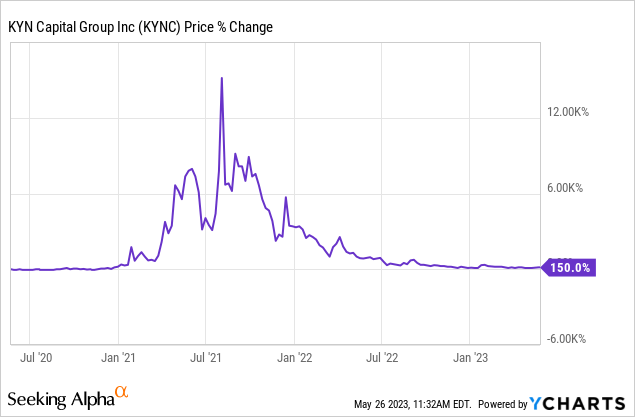

The examples were even worse than this in the first half of 2021. Investors turned their focus to penny stocks next. Viper Networks (OTCPK:VPER), Icon Media Holdings (OTCPK:ICNM), and KYN Capital Group (OTCPK:KYNC) were a few examples. In many cases, the penny stock businesses didn't even exist anymore. That didn't stop investors from bidding up shares to thousands of % gains:

In most of these cases, the fundamental value of the business, if there was one, was nearly zero. As a whole, these less-than-micro caps went full circle from worthless, to insanity, to worthless. Don't lose money.

The Difference Between Dip and Downfall

It's much easier to avoid losing money when the business that we buy is turning a profit. Most Seeking Alpha members likely avoided the pitfalls of these egregious speculations in non-existent companies. But many have been surprised by the weak performance of widely covered companies that do make a profit. It's important, then, to distinguish the difference between what is a "dip," as described as market mispricing, and a "downfall" from which the company cannot recover except for very extended periods of time.

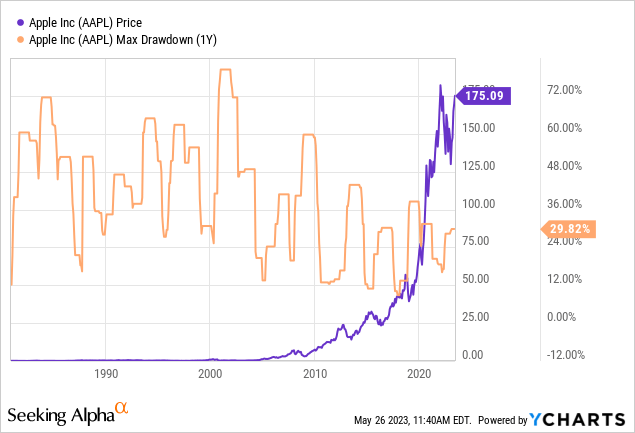

Apple (AAPL) is a fantastic example. The shares lost over 70% in the wake of the 2000 crash. We know of one particular AAPL shareholder who decided to sell over 100,000 shares during that correction, a position that would be worth over $17 million today. That was a dip.

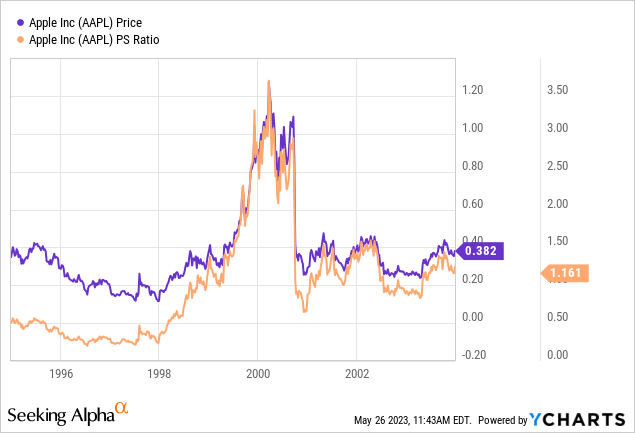

It requires careful due diligence in that moment to know if the company is worth holding for the long term. If we were not willing to do the research we simply would not invest in individual companies. But this example does illustrate the importance of buying great companies for a reasonable price. Prior to the decline, AAPL traded up to a price to sales ratio of 3.5x.

At the time, the company's normal PS ratio was around 0.5x. This should have served as a warning to investors that the price does not provide a margin of safety. A forwarding looking investor that had invested when the share price was between $0.2-0.3 in 1996-1998 could have the cost basis and emotional control to withstand the 70% decline in 2000-01. An investor buying at $1.00 a share will fare far less well.

The Efficient Market Hypothesis says that the share price set by the market reflects the information and knowledge available at the time, resulting in an always fair price. Related, market participants often cite price as an indicator of future company performance. It is a basis for technical analysis and supports the idea of value traps. Our perspective differs somewhat.

We believe there are times when the market fairly prices company stock, there are times when price is indicating expected weakness, and there are value traps. But we believe the market does not always fairly value company shares and we think the data above supports that view.

One such example that we can point to is that of Comcast (CMCSA). We published a bullish stance on CMCSA in October. This happened to coincide with a turn in the overall market. Our article came very close to the intermediate bottom in CMCSA's share price, a sheer coincidence. But the fact is that shares had been falling 53% for 405 days when we initiated our bullish position. Since then, shares have traded up 38%. We reached our bullish conclusion by doing the due diligence and determining a fair price.

Seeking Alpha

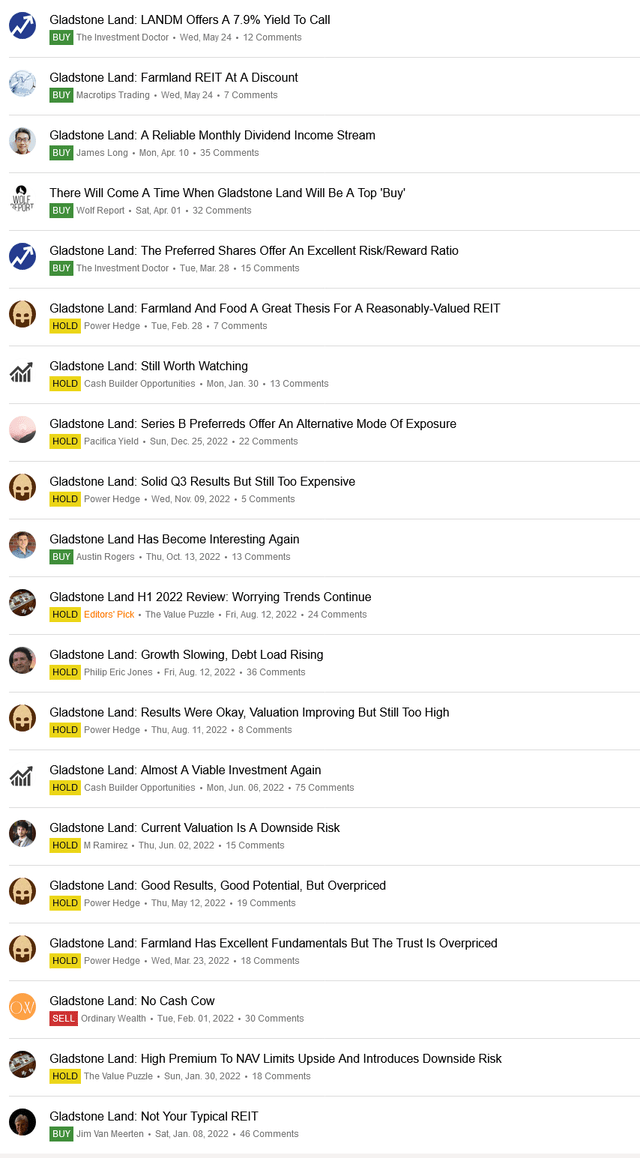

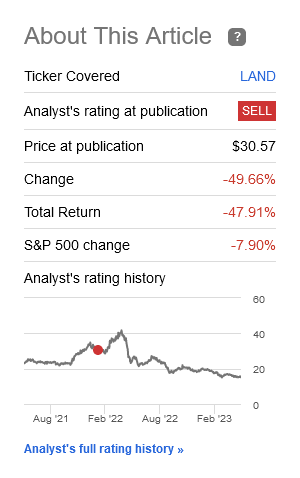

Another example is Gladstone Land Corp. (LAND). While the overwhelming majority of SA analysts were positive on the stock, we were solely bearish. Our article is the only sell rating since January 2022:

Seeking Alpha

The consensus view of the company was that it makes for a great inflation hedge and the U.S. was experiencing significant inflation. In our thesis, we acknowledged the merits of LAND being a well managed farmland REIT as an inflation hedge. But we pointed out the unreasonable valuation of the shares which we believed to be a result of few options in the equity space to invest in farmland and exuberance for the asset class. In the U.S., only two REITs offer investors farmland exposure which are FPI and LAND.

We pointed out that even LAND itself thought that its shares were overvalued. This is what we wrote:

What's worse is that the company's own estimated NAV per share is $13.80, 54% below the share price.

At first, it looked like we were wrong when shares continued to rally 35%, a perfect example of the market being irrational longer than we can remain solvent (to adapt from John Maynard Keynes). We were too gun-shy to short the shares but we should have. Since publication, the shares have declined by 49.6%. The company's own estimate of NAV per share is now $17.12 which is above the share price of $15.39. The shares are starting to become interesting with the AFFO yield of 4.6% above its normal AFFO yield of 4.2%.

Seeking Alpha

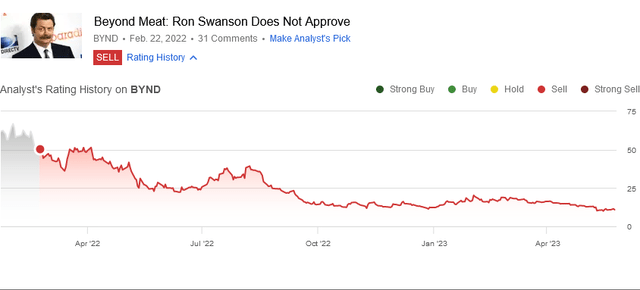

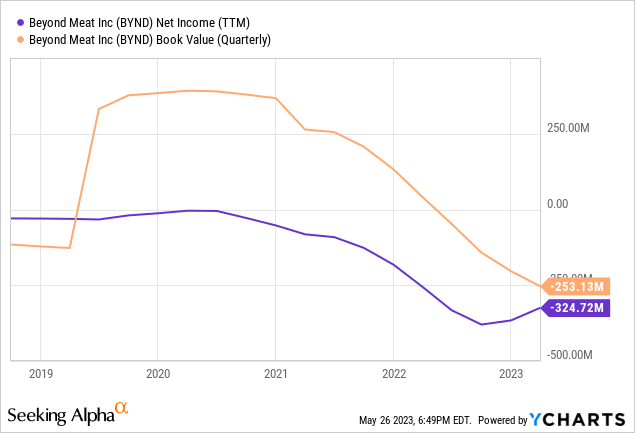

Another equity that we were confident to avoid was Beyond Meat (BYND). Our thesis was that the company was losing cash and its negative net income would continue to decline which was eroding shareholder equity. Looking at the market, we were skeptical that the brand could turnaround margins due to apathetic consumers. It was a prudent decision, as shares have declined by 80% since.

Seeking Alpha

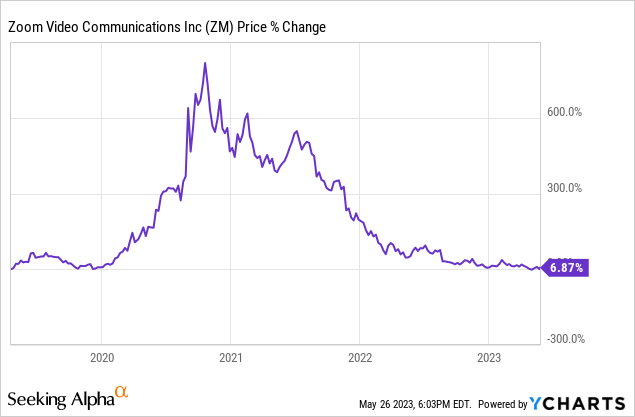

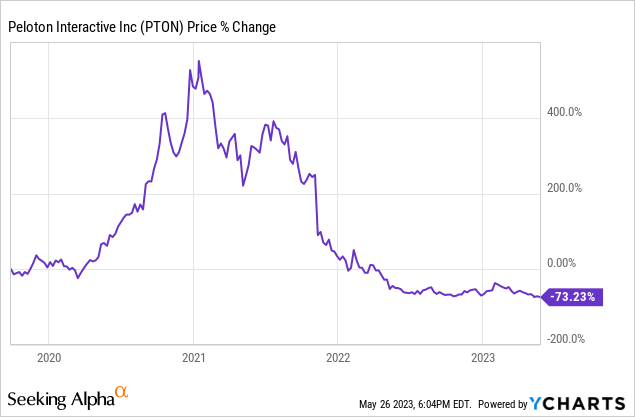

During the past 3 years, there have been many widely covered equities that we did not buy. For over a year we looked foolish and it certainty felt like it, too. Two such examples are Zoom Video Communications (ZM) and Peloton Interactive (PTON). Both stocks rose by hundreds of percent in a matter of months, only to slowly and painfully sink below their pre-covid prices.

Our assessment of stocks like these at the time was that valuations were not supported by the growth which was a function of excessive liquidity and an acute surge in consumer demand, both temporary. Will these companies return to their former glory? One day, perhaps, they can recover like AAPL. But for those that subscribe to that bull case, the time to invest would be now, not 2 years ago.

This would not be a fair assessment without acknowledging our mistakes. We have made plenty of bad calls, some of which are experiencing a "dip" while others are in downfall. One such example is our bull call on wheat futures. Our thesis was that wheat shortages would continue to support elevated prices, in part as a consequence of the war in Ukraine.

That thesis has proven incorrect. Despite low inventories, poor crop conditions in major growing regions of the world, and war in Ukraine continuing no such global shortage manifested. We identified that our thesis was incorrect in September 2021 and updated readers that we were closing our position. The WEAT ETF had declined by 22% but we were able to offset some of the losses with our covered call options.

Seeking Alpha

In pure irony, The Economist published a magazine cover titled "The Coming Food Catastrophe" mere days before our publication. We saw the cover which gave us pause on our thesis as a contrarian indicator. Ultimately, the fundamentals had us convinced that our gut feeling was wrong. That contrarian indicator turned out to be bitterly accurate at identifying the top in commodity prices. It stands as a testament to the power of assessing market sentiment. Often, when fundamentals are the most bullish that is precisely the time to sell. The same can be true about the opposite.

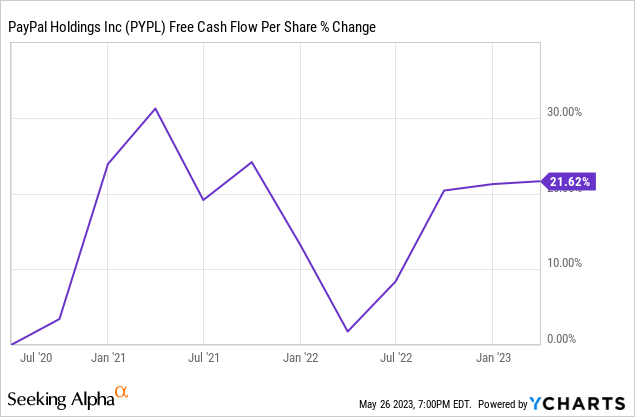

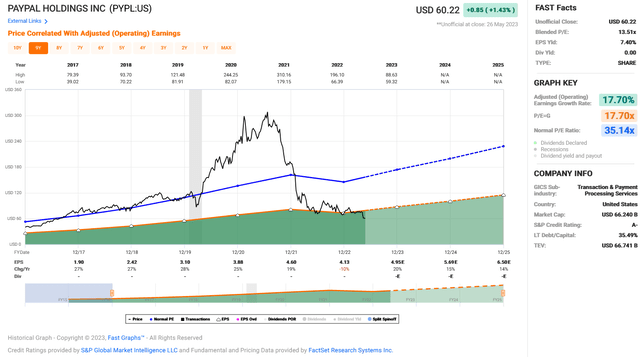

In contrast, we remain bullish on one stock that believe continues to dip which is PayPal Holdings (PYPL). We believed the stock was overvalued prior to the 2022 and did not start a position until early 2022. That patience proved to be prudent. Shares have been relentlessly falling, down 80% from its peak, 37% from our publication, and a shocking 26% from the COVID crash lows.

Seeking Alpha

Yet, over the last three years the company has grown free cash flow by 21.6%. Shares now trade at an adjusted operating earnings yield of 7.4% and a price to sales of 2.44x. Analysts expect revenue and earnings growth to continue slightly below trend. Shares have now reached our "strong buy" territory.

FAST Graphs

Conclusion

Here we are, weathering the dip in names like PYPL. This is due to our conviction in the positions, a product of our due diligence. We remember Mr. Buffett's words always. When evaluating any company, we seek to answer the question: where can we lose money?

Making prudent investment decisions is required to be successful in the long term. This requires the right measure of self discipline, patience, and margin of safety. In general, the market moves up. It's difficult enough to achieve alpha without the impediment of making poor investment decisions. The first step is knowing how not to lose money.

"lose" - Google News

May 27, 2023 at 02:36PM

https://ift.tt/qmUlK1Z

Our Favorite Warren Buffett Advice: Do Not Lose Money - Seeking Alpha

"lose" - Google News

https://ift.tt/0IzAxeJ https://ift.tt/HOo5Ure

Bagikan Berita Ini

0 Response to "Our Favorite Warren Buffett Advice: Do Not Lose Money - Seeking Alpha"

Post a Comment