(Bloomberg) -- Whether they favor debt-limit brinkmanship or not, most Americans are alarmed by the level of US government borrowing. Treasury Secretary Janet Yellen isn’t one of them.

Most Read from Bloomberg

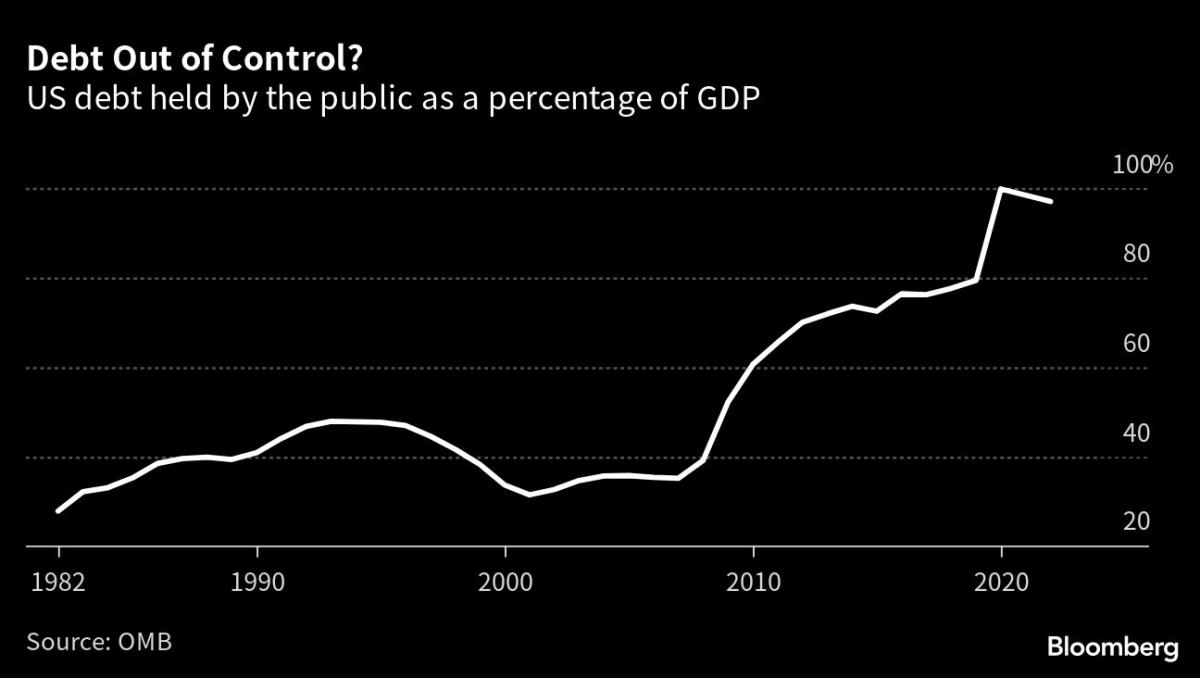

Outstanding debt held by the public stood at $23.9 trillion as of the end of 2022. That’s 97% of gross domestic product, using the measure most popular among economists — roughly triple what it was 20 years earlier, and forecast to keep climbing. It’s a figure at the heart of the debt-ceiling fight now inching toward resolution.

“We have the highest debt than we ever had before,” House Speaker Kevin McCarthy — who negotiated a deal with the Biden administration to trim outlays, and must steer it through Congress this week to avert a default – said on May 24. “I just don’t think that’s right.” Plenty of others, including Federal Reserve Chair Jerome Powell, have warned that the US debt trajectory is “unsustainable.”

Don’t count Yellen among the alarmists, though. That’s partly because she’s using a different debt yardstick.

The former Fed chair, regarded by many as the country’s most experienced economic policymaker, shows little concern when reflecting on government spending. “That is not something to feel we’re in a catastrophic situation,” she told Bloomberg News in a May 13 interview.

‘Charged It Up’

One reason she’s sanguine is that Yellen is among a number of prominent economists to embrace an alternative method for measuring the sustainability of the nation’s debt. Instead of looking at the pile of outstanding bonds as a share of the economy’s output, she prefers the ratio of interest payments — crucially, after adjustment for inflation — to GDP.

In other words, take the amount of money the government spends on interest payments in a given year, divide by the size of the economy, then subtract inflation. The lower the outcome, the better.

With all the caveats that public finances and household budgets are fundamentally different things, the logic is similar to assessing the affordability of a mortgage. What matters most isn’t necessarily the amount borrowed, but how much a homeowner has to pay each month or year compared with their income over the same period.

McCarthy prefers the analogy of a credit card. He likened Democrats to a family that “charged it up, and year after year they just kept raising the limit, until they owed more money on the credit card than they make in an entire year.”

Using Yellen’s preferred measure, the larger public debt load hasn’t imposed much of an interest burden, at least so far.

The government’s interest bill has fallen in recent decades as a share of the economy, thanks to lower borrowing costs over the period. Net interest as a percentage of GDP, without adjusting for inflation, has averaged about 1.5%, though it climbed to 1.9% in 2022 after the pandemic borrowing surge.

Factor in inflation, and interest-to-GDP has frequently been negative, even before the burst of post-Covid price increases. Looking ahead, the White House Office of Management and Budget expects Yellen’s measure to rise back above zero in 2024, as inflation ebbs, and then to top out at 1.1% in 2032-33. That’s a level the Treasury secretary says is “quite reasonable.”

‘Inflated Away’

Jason Furman, a professor at Harvard University and former economic adviser to President Barack Obama, agrees. In a 2020 paper, he and former Treasury Secretary Lawrence Summers argued that policymakers should aim to keep real net interest from rising above 2% of GDP.

The metric favored by Yellen is the right one to use, Furman says, because it’s important to factor in the opposite effects that interest costs and inflation have on the debt burden.

When rates and prices are both going up, Furman says that “in one sense, next year’s debt is even bigger than this year’s debt, because it goes up with interest. But in another sense, next year’s debt is smaller, because part of it is inflated away and so you don’t need to pay back as much.”

Still, Furman concedes the 2% threshold he and Summers arrived at for real net-interest-to-GDP is “arbitrary. It’s based on looking at the experience in other countries, the historical experience in the United States, our gut instinct, et cetera. I’m not positive it’s right.”

His co-author Summers, who is a paid contributor to Bloomberg Television, warned earlier this year that a rising debt burden could end up pushing interest rates higher, which adds pressure on the budget deficit and could turn into a “vicious cycle.”

‘Risk Management’

More than any precise level, it’s the trajectory of debt that can prove critical. One big threat for those who are watching Yellen’s metric is a scenario in which interest rates stay high even after inflation subsides. That would see debt-service costs add to the burden without being offset by rising prices, like they are now.

That, Yellen has acknowledged, would introduce considerable problems. But she doesn’t expect it to happen because she’s in the camp of economists who anticipate the low-inflation, low-rate regime that dominated the last two decades to return once the pandemic price surge is beaten down by the Fed.

Wendy Edelberg, a former chief economist at the Congressional Budget Office, says better budgeting will be needed in the long run, because “you can’t have the federal government taking action over time that perpetually reduces the amount of savings in the economy and perpetually crowds out ever more private investment.”

In the meantime, she advocates keeping an eye on a range of debt measures to figure out where danger may be lurking. “Part of this is just risk management,” she says.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.

"lose" - Google News

May 31, 2023 at 06:00PM

https://ift.tt/DRhabfi

Why Yellen Doesn’t Lose Sleep Over US Borrowing That Alarms Most Americans - Yahoo Finance

"lose" - Google News

https://ift.tt/51d9apP https://ift.tt/F1wNOzb

Bagikan Berita Ini

0 Response to "Why Yellen Doesn’t Lose Sleep Over US Borrowing That Alarms Most Americans - Yahoo Finance"

Post a Comment