lindsay_imagery

Introduction

V.F. Corporation (NYSE:VFC), founded in 1899, is a multinational company specializing in apparel and footwear. It is considered one of the largest clothing conglomerates globally. The company boasts a diverse portfolio of popular brands such as The North Face, Vans, Timberland, and Dickies.

Despite its well-established reputation, the company recently faced significant challenges in the stock market. Since May 2021, its stock has experienced a drastic decline of 80% without substantial recovery intervals. However, this name seems to be well-liked by Wall Street and SA experts. This divergent view from the market and analysts has piqued our interest.

Ratings (Seeking Alpha)

Upon careful examination of V.F. Corporation's financials and strategy, we believe several factors contribute to the decline in its stock value.

Market appears cautious on the plan

After announcing another long-term plan for the company in September 2022, the previous CEO and chairman, Steven Rendle abruptly announced his retirement in December 2022.

Benno Dorer, the current interim CEO and chairman, took over and is also conducting a search for a new permanent CEO.

Benno Dorer gave out the financial outlook for FY2024 as follows:

Total VF revenue flat to up slightly in constant dollars

EPS of $2.05 to $2.25

Free cash flow of about $900 million

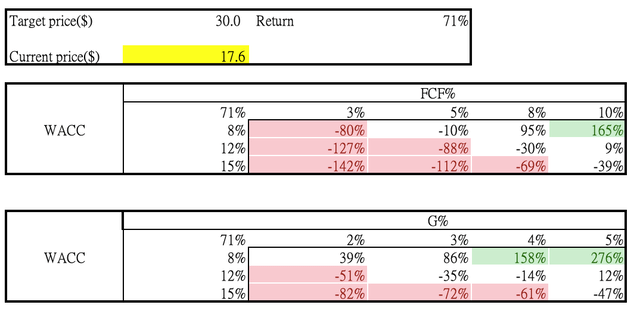

If we used the guidance as model input for FY2024 along with the following assumptions:

- WACC: 8%

- Free cash flow margin: 8%

- Terminal growth rate: 3%

- Net debt:5832 million (Q42023 data)

- Shares outstanding: 388 million (Q4 2023 data)

It was estimated that the fair value of the stock would be 71% higher than the current price.

Sensitivity analysis (LEL Investment)

In addition, its valuation multiple seems cheap. Its P/E ratio is lower than the sector median and its 5-year average level.

Valuation multiple (Seeking Alpha)

We are of the opinion that the stock is currently undervalued, mainly because (1) the current interim management lacks a proven track record, (2) the former CEO failed to achieve the original goals, and (3) the current brands are not well-positioned. Consequently, the market has maintained a cautious outlook on the stock's future prospects in our view.

Former CEO failed to achieve the original goals

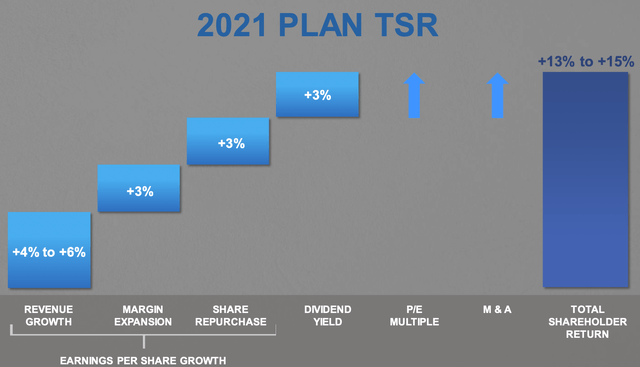

In 2017, Steven E. Rendle, the former Chief Executive Officer, set ambitious goals of achieving a 13–15% annual shareholder return and a revenue growth CAGR of 4–6%.

2017-2021 Plan (VFC)

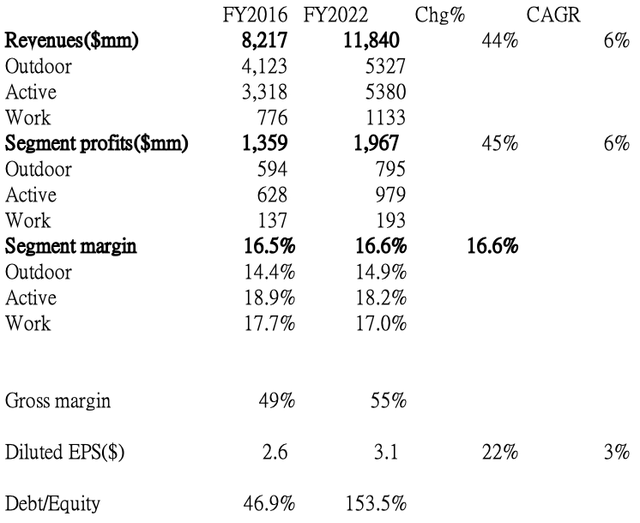

However, the company's diluted EPS growth CAGR from FY2016 to FY2022 was only 3%. This was far below the expectation of EPS growth of 12%, indicating a failure to meet the target.

Financials by segment (VFC)

The company's Q4 FY2023 earnings report, which was released on May 23, provided more evidence of the situation's deterioration. The company had another goodwill impairment at Supreme. In FY2023, the company reported a total of $735 million in goodwill impairment, with $394 million attributed to Supreme. The acquisition of Supreme in FY2021 incurred $1.25 billion in goodwill, further burdening the company's debt level, which rose to 228% in FY2023 from 49% in FY2016. Unfortunately, Supreme's performance in FY2023 was disappointing, with revenue and operating income declining by 7% and 22%, respectively.

Western Coalition Failure as the Result of Poor Execution

The company faced challenges in increasing its non-U.S. revenue from 45% to the targeted 52%, as promised by the former CEO. In FY2023, non-U.S. revenues accounted for only 42% of total revenues. This shortfall was primarily due to underperformance in the APAC region, stemming from the company's strong stance on supply chain initiatives, such as the boycott of cotton sourced from Xinjiang. This led to a significant boycott by Chinese consumers, impacting the company's presence in the region.

The company pursued an aggressive approach to enhancing supply chain efficiency by actively participating in international organizations like the Better Cotton Initiative ("BCI") and the International Fur-Free Alliance. These initiatives were aimed at increasing the company's bargaining power with material suppliers. However, the strategy had a negative impact on APAC revenues, as Chinese brands like Anta and Li Ning benefited from the boycott and aggressively gained market share. Anta and Li Ning reported growth of 8% and 13%, respectively, in 2022, with Anta expected to surpass Nike, Inc., (NKE) in revenues in China, altering the competitive landscape.

In the U.S., the company faced stiff competition from other brands. Its wholesale revenues declined by 2% in FY2023, while Nike and Skechers experienced a significant increase of 26% in wholesale sales in 2022. Adidas also reported double-digit growth in the U.S. market during the same period. Furthermore, revenues from the top 10 largest customers for V.F. Corp. decreased by 14% in FY2023.

Vans and Timberland's Expansion Challenges

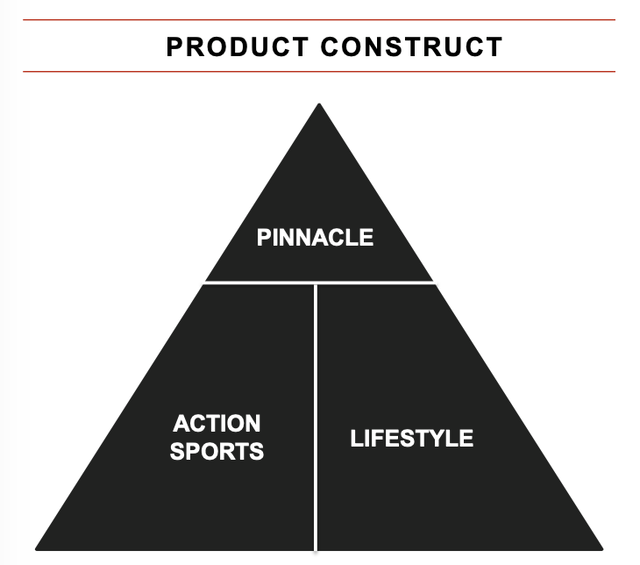

In an effort to adapt to the post-COVID athleisure trend, Vans launched new products that focused on comfort and performance, such as the Van Ultrarange and MTE. While the management considered the performance of Ultrarange and MTE positive, we believe this shift indicates a loss of focus on their core offerings. Despite Ultrarange and MTE experiencing growth of 51% and 34%, respectively, Vans' overall brand sales declined by 8% for the year, while its competitor Converse saw an 8% increase. The management's interest in expanding Vans through an extended product offering, known as the pinnacle strategy, might hinder the brand's performance unless it introduces innovative breakthrough products.

Pinnacle strategy (VFC)

In an attempt to expand beyond streetwear, Vans ventured into the realm of extreme sports such as surfing and snowboarding. While the concept may seem appealing, the extreme sports market already boasts several formidable players. Established surf brands like Quiksilver, Billabong, and Rip Curl have earned recognition for their performance-oriented offerings. Similarly, snow brands such as Burton, Salomon, and Columbia are robust competitors in terms of performance gear. Without innovative breakthrough products, it is unlikely that Vans' strategy will yield significant results in these highly competitive markets. Additionally, Vans' Ultrarange and MET face strong competition from industry giants like Nike and Adidas, further intensifying the challenge. To succeed in these domains, Vans will need to deliver unique and compelling offerings that differentiate the brand from its competitors.

Timberland, likely recognizing the threat of athleisure trend to its position, endeavored to elevate its brand image. In 2018, the company divided its Timberland business into Timberland and Timberland PRO, aiming to expand its presence in the outdoor and fashion sectors. An ambitious move included a collaboration with Jimmy Choo to target the women's market. Timberland's mountain products were designed to showcase the brand's original strengths of durability, waterproofing, and premium leather. However, the mountain shoe and fashion segments are highly competitive arenas. Mountain footwear necessitates not only durability but also comfort and proper design to accommodate the challenging mountain environment. Notably, prominent performance brands like The North Face, Patagonia, and Mammut dominate this space.

Our take

In our view, the management pursued aggressive monetization strategies by expanding into non-core categories, taking advantage of the macro tailwind in FY2022. Nevertheless, these endeavors were fraught with risk and lacked a solid foundation of long-term planning. As macroeconomic conditions weakened in FY2023, the company encountered a decline in revenues and an excessive accumulation of inventory. The former CEO may have benefited from record results in FY2022, but the stock price then fell by 80% as a result of anxiety about the company's future. Merely changing the management may not be sufficient to restore market confidence in our opinion, as inventory levels need to be reduced to a more comfortable level. Its inventory remained 62% higher compared to the previous fiscal year-end. We believe that the company is not well-positioned against the competition.

During the Q4 earnings call, the management highlighted their plans to decrease the SKU count by 30% by the end of FY2024. For Timberland, the company intends to leverage core icons for consistent growth and emphasize its heritage and authenticity in outdoor and work products. Regarding Vans, the focus will be on preserving the brand's heritage, which is deeply rooted in action sports culture.

While the return to core for the brands is viewed positively, caution is warranted due to the management's poor track record in achieving their goals. The search for a new CEO is expected to be completed within six months. The interim CEO appears focused on defensive tactics currently. However, in the fiercely competitive shoe and apparel sector, playing defense is dangerous in our view. We believe that the company will continue to lose market share to rivals in the United States and China. As Timberland, Vans, and Supreme account for more than 50% of total revenues and have faced headwinds, we believe that the company might still be experiencing difficulties until new management and a new strategy are in place.

Therefore, we think the optimal time to purchase this stock would be once the new CEO takes over. Even if the value is favorable right now, additional downside can be on the horizon. We rate the stock as "Neutral".

"lose" - Google News

June 01, 2023 at 05:56AM

https://ift.tt/gPjFhqJ

V.F. Corporation: Continues To Lose Market Share (NYSE:VFC) - Seeking Alpha

"lose" - Google News

https://ift.tt/51d9apP https://ift.tt/F1wNOzb

Bagikan Berita Ini

0 Response to "V.F. Corporation: Continues To Lose Market Share (NYSE:VFC) - Seeking Alpha"

Post a Comment